Open, Permissioned DISTRIBUTED PLATFORM

Capitalize on the new digital economy—transact openly and securely, at scale and across networks

The leading blockchain platform powering the tokenization of traditional financial assets and currencies. The next generation of Corda delivers on R3’s promise of enabling a connected ‘network of regulated networks’.

SPEED UP AND SCALE UP

The foundation you need to move forward

Designed to work with today’s financial services industry and with existing enterprise technology, Corda is a permissioned tokenization platform that lays the foundation for seamless and secure interoperability across other open enterprise DLT networks.

SMART CONTRACTS, TOKENIZATION AND LEDGER ALL IN ONE

Who trusts Next-Gen Corda to power a new breed of financial services?

Global financial leaders rely on R3’s Corda because it is a modern cloud-based DLT platform that can scale for growth and large volumes, while offering network model flexibility. Corda uses standard sets of technologies to enable ease-of-deployment and integration with existing systems.

Want quick facts?

Discover facts about Corda

Fact sheet

Corda Fact Sheet

BLOG

Embracing a New Era of Digital Finance

Native privacy, security, scalability and ease-of-integration

The Corda difference

At R3, we recognize the journey to a new digital economy will be an evolution—not a revolution. And every Corda design choice was made with this key premise in mind.

An Open core platform that grows with you

Open source and open for innovation

Corda is distributed as a single open-source code base to foster developer contributions and reduce total cost of ownership. The open-source version is production-ready, includes support options and is available under an Apache 2 license. We do offer an enterprise licensed version with additional database integration features and 24/7 support for customers who require it.

Professional Services is available to quicken your time to market.

INTEGRATE WITH ASSETS THAT ORIGINATE ON A NON-CORDA NETWORK.

R3’s commitment to regulated network interoperability

Blockchain is a once-in-a-generation innovation that will move industries away from siloed processes and foster inter-connected public and private networks. That’s why we’re actively engaged in proof-of-concepts that show non-traditional digital assets coming securely into and out of a regulatory-compliant Corda-based network.

We’ve also set up a Hyperledger Lab Harmonia–a set of principles, requirements, designs and code samples to help regulated blockchain networks interoperate with industry partner Adhara.

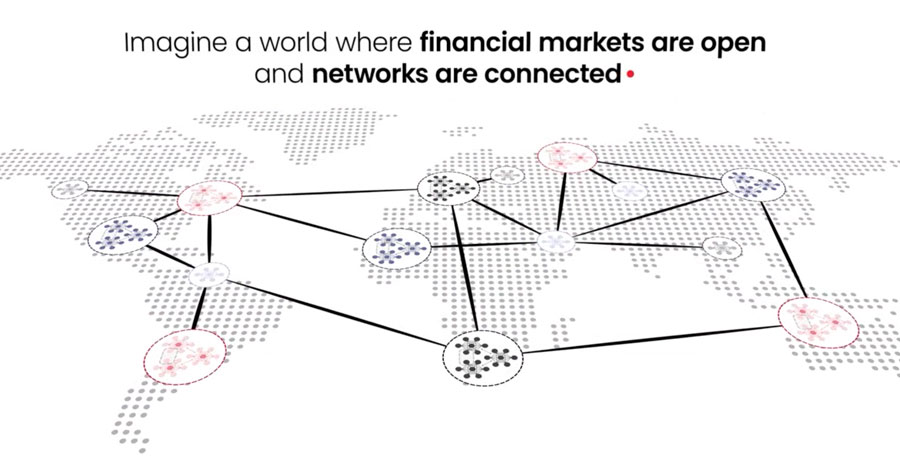

The power of distributed connected networks

Single identity with mutual memberships

Corda provides the ability to maintain identities across all Corda-based networks and ensures all CorDapp identities are tied to a legal entity reducing security risks.

Asset fluidity

Digital assets and currencies can move freely across network boundaries using well-defined trusted exchange protocols that meet regulatory demands for privacy and security.

Connecting regulated networks

R3 is building interoperability to ensure Corda can act as a bridge to liquidity beyond the Corda ecosystem. In the future, non-traditional digital assets will travel securely into and out of regulated Corda-based networks.

REGULATED MARKETS EXPERTISE

Discover use cases and insights by exploring the Digital Assets Hub

Featured resources

Insights and resources to help guide you on your digital journey

Ready to start building?

Build distributed apps that future-proof

your business.

"*" indicates required fields